The Role of Cryptocurrency in Global Finance

The Role of Cryptocurrency in Global Finance – Cryptocurrency has grow to be an more and more standard type of digital foreign money in recent times, and its position in international finance is rising quickly. Cryptocurrency is a digital asset designed to work as a medium of change that makes use of cryptography to safe its transactions, management the creation of extra models, and confirm the switch of property. Cryptocurrency is decentralized, which means it’s not managed by any authorities or central financial institution. This makes it engaging to many individuals, as it’s not topic to the identical laws and restrictions as conventional currencies. Cryptocurrency has the potential to revolutionize international finance, because it affords a safe, quick, and cost-effective strategy to switch cash throughout borders. It additionally has the potential to scale back the price of worldwide funds, enhance monetary inclusion, and supply entry to monetary providers to those that might not have entry to conventional banking providers. This text will discover the position of cryptocurrency in international finance and the potential advantages it might convey.

Contents

Exploring the Potential of Cryptocurrency to Revolutionize World Monetary Markets

Cryptocurrency has the potential to revolutionize international monetary markets in ways in which had been beforehand unimaginable. This revolutionary know-how has the potential to revolutionize the best way we take into consideration cash, banking, and monetary transactions.

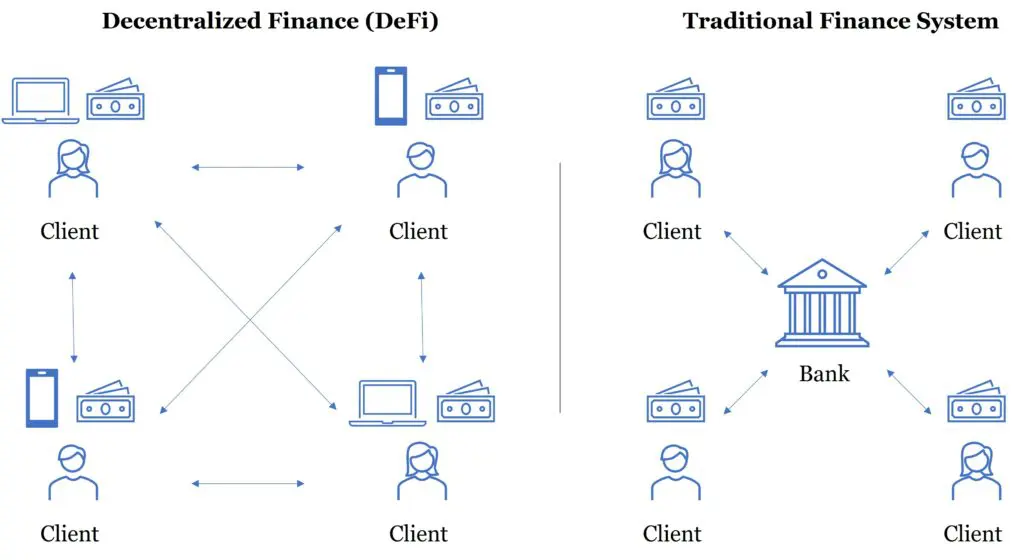

Cryptocurrency is a digital asset that’s secured by cryptography, making it almost not possible to counterfeit or double-spend. It’s decentralized, which means it’s not managed by any single entity or authorities. This makes it a pretty choice for these trying to make monetary transactions with out the necessity for a third-party middleman.

The potential of cryptocurrency to revolutionize international monetary markets is immense. For starters, it might scale back the price of worldwide funds and remittances. At the moment, sending cash overseas may be costly and time-consuming. With cryptocurrency, these prices may very well be drastically lowered, making it simpler and extra reasonably priced to ship cash throughout borders.

Cryptocurrency might additionally make it simpler to entry capital. At the moment, many individuals in creating nations are unable to entry conventional banking providers. Cryptocurrency might present an alternate means for these people to entry capital, permitting them to start out companies and spend money on their future.

Cryptocurrency might additionally make it simpler to spend money on international markets. At the moment, investing in overseas markets may be troublesome and costly. With cryptocurrency, traders might simply entry international markets, permitting them to diversify their portfolios and reap the benefits of new alternatives.

Lastly, cryptocurrency might make it simpler to trace and audit monetary transactions. At the moment, it may be troublesome to trace and audit monetary transactions, making it troublesome to detect fraud and cash laundering. With cryptocurrency, these transactions may very well be tracked and audited in real-time, making it simpler to detect and forestall fraud.

The potential of cryptocurrency to revolutionize international monetary markets is immense. It might scale back the price of worldwide funds, make it simpler to entry capital, and make it simpler to spend money on international markets. It might additionally make it simpler to trace and audit monetary transactions, making it simpler to detect and forestall fraud. Because the know-how continues to evolve, it’s possible that we’ll see increasingly more purposes of cryptocurrency within the monetary world.

Analyzing the Impression of Cryptocurrency on Worldwide Commerce and Funding

Cryptocurrency has been gaining traction in recent times, and its impression on worldwide commerce and funding is turning into more and more obvious. As a digital type of cash, cryptocurrency has the potential to revolutionize the best way we conduct worldwide transactions.

Cryptocurrency has the potential to scale back transaction prices and enhance effectivity in worldwide commerce and funding. By eliminating the necessity for third-party intermediaries, comparable to banks and different monetary establishments, cryptocurrency can scale back the price of worldwide transactions. This might result in decrease costs for items and providers, making them extra accessible to customers all over the world. Moreover, cryptocurrency transactions are usually sooner than conventional strategies, which might result in sooner supply of products and providers.

Cryptocurrency additionally has the potential to extend transparency in worldwide commerce and funding. Through the use of blockchain know-how, cryptocurrency transactions are recorded on a public ledger, making them safer and clear. This might assist to scale back fraud and corruption in worldwide transactions, in addition to enhance belief between buying and selling companions.

Lastly, cryptocurrency might additionally assist to scale back foreign money change danger in worldwide commerce and funding. Through the use of cryptocurrency, merchants and traders can keep away from the chance of foreign money fluctuations, as cryptocurrency just isn’t tied to any explicit nation or foreign money. This might make worldwide transactions extra steady and predictable, which might result in elevated funding and commerce.

Total, cryptocurrency has the potential to revolutionize worldwide commerce and funding. By decreasing transaction prices, growing transparency, and decreasing foreign money change danger, cryptocurrency might make worldwide transactions extra environment friendly and safe. As cryptocurrency continues to realize traction, its impression on worldwide commerce and funding will grow to be more and more obvious.

Analyzing the Regulatory Challenges of Cryptocurrency within the World Monetary System

Cryptocurrency has grow to be a serious disruptor within the international monetary system, and its fast progress has raised a variety of regulatory challenges. As governments and monetary establishments grapple with easy methods to regulate this new asset class, it is very important perceive the implications of cryptocurrency on the worldwide monetary system.

Cryptocurrency is a digital asset that’s not issued or backed by any authorities or central financial institution. It’s decentralized, which means it’s not managed by any single entity. This makes it engaging to traders, as it’s not topic to the identical laws as conventional currencies. Nonetheless, this additionally makes it troublesome to manage, as it’s not topic to the identical oversight as conventional currencies.

One of many main regulatory challenges posed by cryptocurrency is the dearth of transparency. Cryptocurrency transactions are nameless, making it troublesome for governments and monetary establishments to trace and monitor them. This lack of transparency can result in cash laundering and different illicit actions.

One other problem is the potential for market manipulation. Cryptocurrency markets are extremely unstable and may be simply manipulated by giant traders. This may result in market instability and may have a detrimental impression on the worldwide monetary system.

Lastly, there may be the difficulty of taxation. Cryptocurrency just isn’t topic to the identical taxation guidelines as conventional currencies, making it troublesome for governments to gather taxes on cryptocurrency transactions. This may result in a lack of income for governments and may have a detrimental impression on the worldwide economic system.

These are just some of the regulatory challenges posed by cryptocurrency within the international monetary system. As governments and monetary establishments proceed to grapple with easy methods to regulate this new asset class, it is very important perceive the implications of cryptocurrency on the worldwide monetary system.

Q&A

Q1: What’s cryptocurrency?

A1: Cryptocurrency is a digital or digital foreign money that makes use of cryptography for safety. It’s not issued by any central authority, rendering it theoretically resistant to authorities interference or manipulation.

Q2: How does cryptocurrency work?

A2: Cryptocurrency works by utilizing a distributed ledger system, generally known as a blockchain, to report and confirm transactions. This ledger is maintained by a community of computer systems, and every transaction is secured by a cryptographic signature.

Q3: What’s the position of cryptocurrency in international finance?

A3: Cryptocurrency has the potential to revolutionize international finance by offering a safe, decentralized, and borderless technique of cost. It might additionally present a extra environment friendly and cost-effective strategy to switch cash throughout borders, decreasing the necessity for pricey intermediaries. Moreover, cryptocurrency might present a safer and clear strategy to retailer and switch worth, decreasing the chance of fraud and corruption.

Conclusion

The position of cryptocurrency in international finance remains to be in its infancy, however it’s clear that it has the potential to revolutionize the best way we take into consideration cash and monetary transactions. Cryptocurrency has the potential to offer a safe, clear, and environment friendly strategy to switch cash throughout borders, and it might probably scale back the price of worldwide funds. Because the know-how continues to evolve, it’s possible that cryptocurrency will grow to be an more and more essential a part of international finance.