The Effect of Cryptocurrency on the Banking Industry

The Effect of Cryptocurrency on the Banking Industry – Cryptocurrency has been gaining traction in recent times, and its influence on the banking trade is plain. This text will discover the consequences of cryptocurrency on the banking trade, together with its potential to disrupt conventional banking fashions, its implications for monetary safety, and its potential to revolutionize the way in which we do enterprise.

Contents

What’s Cryptocurrency?

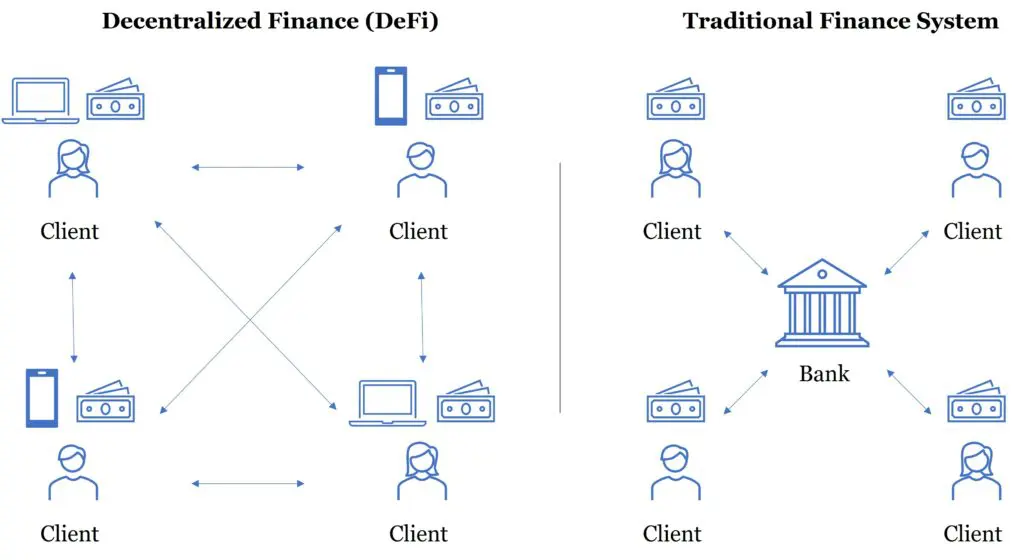

Cryptocurrency is a digital or digital foreign money that makes use of cryptography for safety. It’s decentralized, which means it’s not managed by any authorities or central financial institution. Cryptocurrency can also be nameless, which means customers can stay nameless when making transactions.

How Does Cryptocurrency Have an effect on the Banking Trade?

Disrupting Conventional Banking Fashions

Cryptocurrency has the potential to disrupt conventional banking fashions by offering a substitute for conventional banking providers. Cryptocurrency transactions are sooner and safer than conventional banking transactions, and they aren’t topic to the identical charges and rules as conventional banking providers. This might result in a lower in the price of banking providers, in addition to a rise within the pace and safety of transactions.

Implications for Monetary Safety

Cryptocurrency additionally has implications for monetary safety. Cryptocurrency transactions are encrypted, which means they’re safer than conventional banking transactions. Moreover, cryptocurrency transactions are nameless, which means customers can stay nameless when making transactions. This might result in a rise in monetary safety, as customers wouldn’t have to fret about their private info being compromised.

Revolutionizing the Approach We Do Enterprise

Lastly, cryptocurrency has the potential to revolutionize the way in which we do enterprise. Cryptocurrency transactions are sooner and safer than conventional banking transactions, and they aren’t topic to the identical charges and rules as conventional banking providers. This might result in a lower in the price of doing enterprise, in addition to a rise within the pace and safety of transactions.

Conclusion

Cryptocurrency has the potential to revolutionize the banking trade. It has the potential to disrupt conventional banking fashions, enhance monetary safety, and revolutionize the way in which we do enterprise. As cryptocurrency continues to realize traction, it is very important perceive its implications for the banking trade and the way it may be used to profit each companies and customers.

Q&A

What’s Cryptocurrency?

Cryptocurrency is a digital or digital foreign money that makes use of cryptography for safety. It’s decentralized, which means it’s not managed by any authorities or central financial institution. Cryptocurrency can also be nameless, which means customers can stay nameless when making transactions.

How Does Cryptocurrency Have an effect on the Banking Trade?

Cryptocurrency has the potential to disrupt conventional banking fashions by offering a substitute for conventional banking providers. Cryptocurrency transactions are sooner and safer than conventional banking transactions, and they aren’t topic to the identical charges and rules as conventional banking providers. This might result in a lower in the price of banking providers, in addition to a rise within the pace and safety of transactions. Moreover, cryptocurrency has implications for monetary safety, as transactions are encrypted and nameless. Lastly, cryptocurrency has the potential to revolutionize the way in which we do enterprise, because it may result in a lower in the price of doing enterprise, in addition to a rise within the pace and safety of transactions.