The Tax Implications of Investing in Cryptocurrency

The Tax Implications of Investing in Cryptocurrency – Cryptocurrency has turn out to be more and more fashionable in recent times, with many buyers turning to digital currencies as a option to diversify their portfolios. Nonetheless, investing in cryptocurrency can have vital tax implications, and you will need to perceive the foundations and rules earlier than investing. On this article, we are going to discover the tax implications of investing in cryptocurrency and supply some ideas for minimizing your tax burden.

Contents

What’s Cryptocurrency?

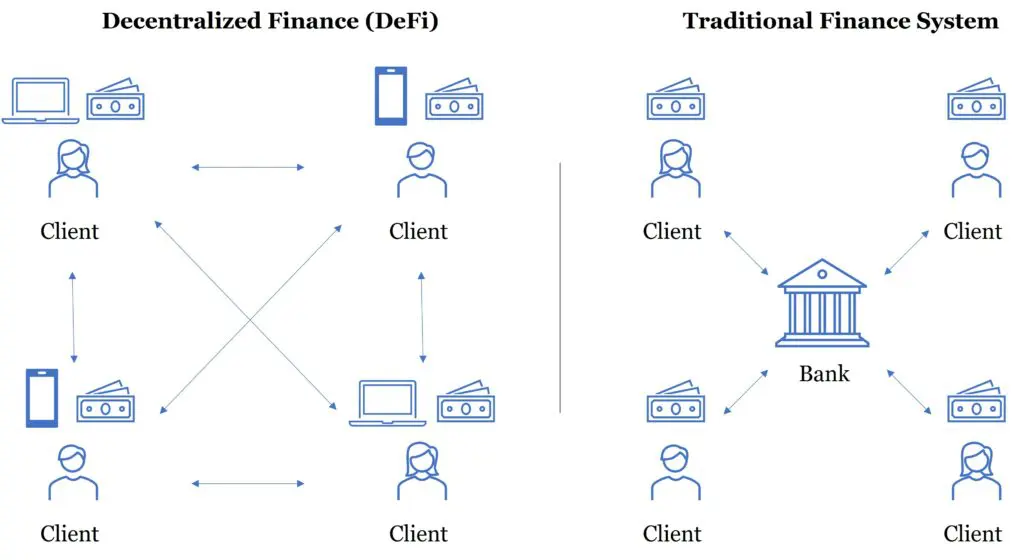

Cryptocurrency is a digital or digital forex that makes use of cryptography for safety. It isn’t issued by any authorities or central financial institution, and it’s not backed by any bodily asset. Cryptocurrency is decentralized, which means it’s not managed by any single entity.

Tax Implications of Investing in Cryptocurrency

Capital Good points Tax

The most typical tax implication of investing in cryptocurrency is capital positive aspects tax. This can be a tax on the earnings you make once you promote or alternate cryptocurrency for an additional asset. The quantity of tax you owe will depend upon the kind of asset you’re exchanging and the size of time you held the cryptocurrency.

Earnings Tax

Earnings tax is one other tax implication of investing in cryptocurrency. This can be a tax on any revenue you obtain from cryptocurrency, similar to mining rewards or curiosity earned from lending. The quantity of tax you owe will depend upon the kind of revenue you obtain and your tax bracket.

Tax Deductions

Investing in cryptocurrency also can present tax deductions. For instance, should you use cryptocurrency to buy items or providers, you might be able to deduct the price of the acquisition out of your taxes. Moreover, should you use cryptocurrency to pay for enterprise bills, you might be able to deduct these bills out of your taxes.

Suggestions for Minimizing Your Tax Burden

- Maintain detailed information of all of your cryptocurrency transactions.

- Perceive the tax implications of every sort of transaction.

- Benefit from tax deductions the place potential.

- Seek the advice of a tax skilled you probably have any questions.

Conclusion

Investing in cryptocurrency can have vital tax implications, and you will need to perceive the foundations and rules earlier than investing. By protecting detailed information, understanding the tax implications of every sort of transaction, and benefiting from tax deductions, you may decrease your tax burden and maximize your earnings.